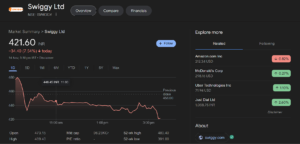

Swiggy Current Valuation and Share Price: How Much is Swiggy Worth Today?

So, this stock just got listed, and now you might be wondering what strategy to take. What does the premium listing mean, and should you hold onto it or cash out? We’ll answer that in this blog. First, check out how the listing went down. It was a strong listing, like I mentioned earlier, especially since the market is weak and no one was really expecting a good listing. It opened on the BSE at 44,112, with over a 5.5 premium!

So, the NSC got listed at ₹420, which means it opened with a solid premium of around 40%. That’s pretty good considering its issue price was just ₹10. Obviously, if it’s listing at ₹420, there’s a good premium happening here. But interestingly, the gray market wasn’t showing that at all; it was only indicating a premium of ₹1. Basically, it was expected to list just ₹1 above ₹90 because the market is pretty weak right now.

Nobody was really expecting such a great response for the listing here, or that the stock would trend upward afterward. After the listing, it hit a high of ₹49 during the day, and at one point, it touched an intraday low of ₹391, but it didn’t drop below the issue price or breach the ₹390 level. So, looking at the high of ₹449, people have made a return of about 15%. That’s ₹1 lakh crore!

The stock has hit its valuation, leading to some pretty good returns. So what do the brokers think? We’ll take you to the experts. Before this listing, Macquarie released a report starting coverage with an underperform rating, setting a target of ₹2,500,000. That’s quite unique and has caught a lot of people’s interest. However, the valuations are high and challenging, so it’s important to stay cautious about that. In fact, there are concerns regarding profitability.

They’ve highlighted this in the report, mentioning it as a valuation, and they believe that focusing on the unit economics in the long run is more important. You could say it’s a bull versus bear scenario since they’ve started coverage on the stock with a buy rating at ₹2,500,000, and the target price is set at ₹70. Compared to the issue price of ₹90, that shows a premium of ₹20. They also mentioned that there are a couple of catalysts for the stock that should start working soon.

They successfully completed their IPO. Secondly, their quick commerce business has undergone a leadership revamp, which could act as a catalyst for the company and help strengthen its turnaround. This report mentions that the amount raised, which is over 1,000 crores, will bolster their balance sheet, allowing them to compete better with their competition. They believe that in the medium term, this will make a difference.

Their quick commerce business is showing strong growth and expansion, which is why a target price of ₹4470 has been set. However, there might be some issues with the listing. No analyst suggested that you should invest in it, who is closely associated with our IPO segment. it mentioned that if you’re willing to take risks, you can definitely invest in this IPO. You can see the current market mood, and given that, investing in any IPO can be tricky.

It seems like there’s a solar IPO coming up, and it’s being listed with a discount. If you’re willing to take on a bit more risk, it mentioned that you might want to invest in this IPO since it could have a flat to positive listing.

What’s better for us than if they themselves review how you should strategize for this IPO?

Swiggy’s valuation is much better compared to Zomato. If you can take the risk, you should definitely invest in it. It’s hit a high of 4449 and hasn’t gone below the issue price yet. I just want to say Whenever any analyst gives a recommendation, it’s a big deal for us because we know that if our call goes wrong, it can really impact the investors’ hard-earned money. So, whenever we make a call, my main mindset is that we shouldn’t let investors lose their capital. If you read my articles, you’ll notice I only give one or two calls; I don’t go for big calls or give out too many because the market mood can be really unpredictable.

It’s really important, no matter how much we talk, if the market isn’t good, then it can be a bit of a gamble with any recommendations we make. I had mentioned at that time that I might be making this call in a pretty negative environment regarding this IPO. That was one thing. But based on my 20 years of experience and all the analysis I’ve done, I felt a bit more confident about the company’s fundamentals. If I had to sum up your view in just a couple of words, I’d say you were cautiously optimistic.

If I’m understanding you right, you were being cautious, but at the same time, you felt there was potential to make money based on the valuation. People have made money at 15 because its intraday high is 4449, and it’s still trading above 4440. So, what’s the deal? that mentioned it could have a flat to positive listing, and that’s exactly what happened. There seems to be buying interest now. we take some profits, or do you think it’s better to hold for the long term since the valuation is pretty cheap compared to Zomato?

Look, when I was looking at it, the main thing was the valuation. They had significantly lowered the valuations compared to the competitors. It’s not just about one or two parameters; we checked a bunch of them. We looked at the price-to-earnings ratio, but we also considered others like price-to-sales and EV-to-sales ratios. Those two or three key ratios made it look really attractive. I want to seriously say that the management has followed a really smart approach here, especially given the current market conditions.

“Our Indian market is falling apart because valuations are too high. Everyone loves high valuations as long as growth keeps up, but with the recent results showing no growth, everything is starting to feel overpriced. That’s why we’ve seen a big drop in the Indian markets. Valuation is a really important factor and we can’t ignore it. On the flip side, look at the high it hit today. My price target was around 450 to 458, and it almost hit 449—so I was pretty much spot on, but no one can be 100% right.”

The level around 450 was hit once, but I feel like the upward trend from here isn’t that strong anymore. The price target was 458, especially if they start delivering good results in the future. They’ve really adopted a solid strategy; in fact, their strategy is even better than Zomato’s. The key will be how well they execute this strategy. If they do it right, we might see this stock giving us even better returns.

In the long run, I think it’s a good idea to take some profits now. It might even go higher from here, but I don’t mind saying that we should at least secure some gains for our investors. My main goal is to protect their capital; even if profits go down, that’s fine as long as their capital stays safe. So, let’s book some partial profits and hold the rest. I’m keeping my fingers crossed, but if everything goes well, I believe we can aim for a target of up to 490.

It could happen, because if the market gets worse from here, it might affect the stock price a bit. Honestly, I’m pretty surprised that it performed well even in such a bad market; that’s impressive. But I think we should hold off for now. Let’s let the price settle over the next couple of days and then consider making a move, but at slightly lower levels. There’s still a valuation gap between Zomato and Swiggy, at least in terms of their price-to-sales multiples.

“I’ve done some calculations here, and it’s a bit narrowed down, so it might drop a little more before we can start buying. But you should definitely take some partial profits and hold on for the long term.

I had also put out an IPO note where I mentioned the same thing—that if you’re investing for limited listing gains, my recommendation was consistent with what went out from Him Securities regarding the IPO. That’s all thanku for reading this article.

You make money from it, and Swiggy’s IPO is a great example of that. So, the focus on trending stocks continues. To keep an eye on these trending stocks, stay tuned with us.

IPO Price Performance Chart for Swiggy:

Key Chart Elements:

- Date of IPO: Initial IPO listing date on BSE and NSE.

- Issue Price: ₹90.

- Listing Prices:

- BSE: ₹44,112 with a 5.5% premium over expected listing.

- NSE: ₹420, reflecting a 40% premium over issue price.

- Highs and Lows on Listing Day:

- Intraday High: ₹4,449.

- Intraday Low: ₹391 (remained above the issue price).

- Target Price by Analysts:

- Short-term targets: ₹450 to ₹458.

- Long-term potential targets: Up to ₹500.

- Expert Commentary:

- Cautious optimism on Swiggy’s long-term prospects.

- Advice to take partial profits but hold for further gains.

- Expected future dips as potential buying opportunities for new investors.

Suggested Chart Design:

- X-Axis: Timeline with dates starting from IPO (listing day) to the present.

- Y-Axis: Stock Price in ₹.

- Price Points:

- Mark the Issue Price at ₹90.

- Mark NSE and BSE Listing Prices (₹420 and ₹44,112).

- Show Intraday High at ₹4,449 and Low at ₹391 on listing day.

- Indicate target price range (₹450-₹458 short-term and ₹490-₹500 long-term).

- Annotations:

- Annotate significant points like IPO price, listing highs and lows, and target prices.

- Add brief comments from analysts indicating buy/sell suggestions.

This chart will help visualize Swiggy’s performance on its listing day, highlight the highs and lows, and indicate future price expectations for potential investors.

Important Link

- पाठ्यक्रम का सामाजिक आधार: Impact of Modern Societal Issues

- मनोवैज्ञानिक आधार का योगदान और पाठ्यक्रम में भूमिका|Contribution of psychological basis and role in curriculum

- पाठ्यचर्या नियोजन का आधार |basis of curriculum planning

राष्ट्रीय एकता में कौन सी बाधाएं है(What are the obstacles to national unity) - पाठ्यचर्या प्रारुप के प्रमुख घटकों या चरणों का उल्लेख कीजिए।|Mention the major components or stages of curriculum design.

- अधिगमकर्ता के अनुभवों के चयन का निर्धारण किस प्रकार होता है? विवेचना कीजिए।How is a learner’s choice of experiences determined? To discuss.

- विकास की रणनीतियाँ, प्रक्रिया के चरण|Development strategies, stages of the process

Disclaimer: chronobazaar.com is created only for the purpose of education and knowledge. For any queries, disclaimer is requested to kindly contact us. We assure you we will do our best. We do not support piracy. If in any way it violates the law or there is any problem, please mail us on chronobazaar2.0@gmail.com

Leave a Reply